A Total Overview of Conventional Mortgage Loans for First-Time Customers

A Total Overview of Conventional Mortgage Loans for First-Time Customers

Blog Article

Understanding the Numerous Kinds Of Home Loan Offered for First-Time Homebuyers and Their One-of-a-kind Advantages

Navigating the variety of mortgage choices available to first-time buyers is crucial for making enlightened economic decisions. Each kind of lending, from standard to FHA, VA, and USDA, offers distinct advantages tailored to varied buyer requirements and circumstances. In addition, unique programs exist to boost price and offer essential sources for those entering the real estate market for the very first time. Recognizing these distinctions can considerably impact your home-buying journey, yet several stay unaware of the finer information that might affect their selections. When examining these options?, what crucial elements should you consider.

Conventional Financings

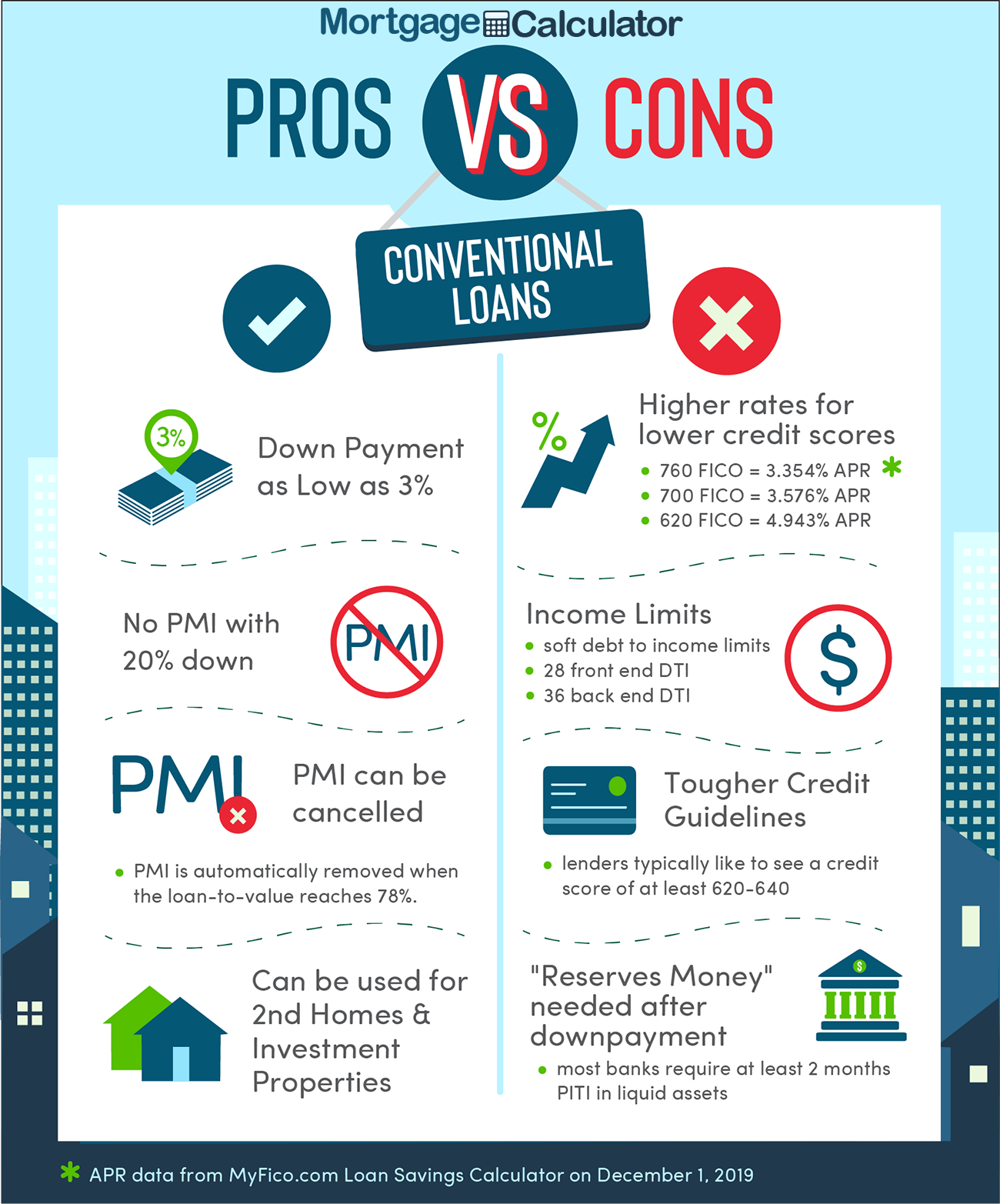

Conventional lendings are a foundation of home loan funding for first-time property buyers, giving a trustworthy option for those looking to acquire a home. These finances are not insured or assured by the federal government, which identifies them from government-backed car loans. Commonly, conventional fundings call for a greater credit report and a much more substantial down payment, usually varying from 3% to 20% of the purchase cost, depending upon the lending institution's requirements.

One of the considerable advantages of conventional lendings is their adaptability. Customers can pick from numerous financing terms-- most commonly 15 or thirty years-- allowing them to straighten their home loan with their financial objectives. In addition, traditional car loans may use lower rate of interest rates contrasted to FHA or VA financings, especially for borrowers with strong credit profiles.

Another advantage is the absence of ahead of time home loan insurance coverage costs, which are usual with government loans. Private home loan insurance policy (PMI) may be required if the down payment is less than 20%, however it can be gotten rid of when the debtor attains 20% equity in the home. In general, traditional financings offer a attractive and feasible financing option for new buyers looking for to navigate the home loan landscape.

FHA Car Loans

For lots of novice buyers, FHA lendings represent an easily accessible path to homeownership. Guaranteed by the Federal Real Estate Administration, these car loans offer flexible credentials requirements, making them suitable for those with minimal credit report or lower earnings levels. Among the standout functions of FHA fundings is their low down payment need, which can be as low as 3.5% of the acquisition cost. This significantly decreases the monetary barrier to access for numerous hopeful property owners.

In addition, FHA car loans permit for higher debt-to-income proportions contrasted to traditional car loans, fitting consumers who may have existing economic responsibilities. The rate of interest rates linked with FHA finances are frequently affordable, more boosting price. Borrowers additionally profit from the ability to include particular closing prices in the funding, which can ease the upfront monetary burden.

However, it is essential to keep in mind that FHA finances need home loan insurance coverage costs, which can enhance monthly repayments. In spite of this, the total benefits of FHA finances, consisting of accessibility and lower first expenses, make them a compelling choice for new homebuyers seeking to enter the genuine estate market. Comprehending these loans is necessary in making informed choices regarding home funding.

VA Loans

VA finances supply a special funding option for qualified veterans, active-duty service members, and particular members of the National Guard and Reserves. These car loans, backed by the U.S - Conventional mortgage loans. Department of Veterans Matters, offer several benefits that make own a home a lot more easily accessible for those that have actually served the country

One of one of the most considerable advantages of VA fundings is the absence of a deposit demand, permitting qualified debtors to fund 100% of their home's purchase price. This attribute is specifically beneficial for first-time buyers who may have a hard time to conserve for a considerable down payment. Additionally, VA finances commonly come with competitive rate of interest, which can lead to decrease monthly payments over the life of the loan.

Another remarkable advantage is the lack of exclusive home mortgage insurance policy (PMI), which is typically required on traditional car loans with reduced deposits. This exclusion can cause significant cost savings, making homeownership much more affordable. Moreover, VA financings supply flexible credit scores requirements, allowing debtors with reduced credit ratings to qualify more conveniently.

USDA Financings

Checking out funding alternatives, newbie property buyers might locate USDA car loans to be an engaging choice, specifically for those wanting to acquire property in country or rural areas. The United States Department of Agriculture (USDA) provides these car loans to promote great site homeownership in marked rural areas, providing an exceptional chance for eligible buyers.

Among the standout features of USDA financings is that they require no deposit, making it much easier for new buyers to get in the housing market. Furthermore, these loans typically have competitive passion rates, which can result in lower regular monthly settlements contrasted to standard financing alternatives.

USDA fundings likewise feature versatile debt needs, enabling those with less-than-perfect credit report to certify. The program's income restrictions make sure that support is routed in the direction of reduced to moderate-income households, further sustaining homeownership goals in country communities.

Furthermore, USDA lendings are backed by the federal government, which minimizes the danger for lending institutions and can simplify the authorization procedure for debtors (Conventional mortgage loans). Because of this, novice buyers taking into consideration a USDA lending might discover it to be a beneficial and easily accessible option for achieving their homeownership desires

Special Programs for First-Time Customers

Many new homebuyers can gain from special programs made to help them in navigating the intricacies of purchasing their first home. These programs frequently supply financial rewards, education, and resources tailored to the special needs of novice buyers.

In Addition, the HomeReady and Home Feasible programs by Fannie Mae and Freddie Mac accommodate reduced to moderate-income customers, providing versatile home mortgage alternatives with lower mortgage insurance policy costs.

Educational workshops held by various companies can also assist first-time customers recognize the home-buying process, boosting their opportunities of success. These programs not only reduce monetary worries but likewise equip buyers with understanding, inevitably promoting a smoother change into homeownership. By discovering these unique programs, newbie buyers can discover useful resources that make the desire for having a home a lot more achievable.

Verdict

Traditional loans are a foundation of home mortgage financing for new homebuyers, supplying a reputable alternative for those looking to buy a home. These finances are not guaranteed or ensured by the federal government, which differentiates them from government-backed finances. Furthermore, standard car loans might provide reduced rate of interest prices contrasted to FHA or VA lendings, particularly check my site for borrowers with strong credit history accounts.

Furthermore, FHA fundings permit for higher debt-to-income proportions contrasted to conventional click this fundings, suiting consumers that might have existing monetary responsibilities. Additionally, VA financings generally come with affordable rate of interest rates, which can lead to lower monthly repayments over the life of the car loan.

Report this page